Dr Pepper Snapple Achieves a Data Advantage

Currently the third largest refreshment beverage business in North America, Dr Pepper Snapple Group (DPS) www.drpeppersnapplegroup.com) is on a mission to become the best company in its market. Established in 2008 following the spin off of Cadbury Schweppes Americas Beverages from Cadbury Schweppes plc, DPS now manufactures, markets and distributes more than 50 brands, including Dr Pepper, Snapple, 7UP, Mott's, A&W, Sunkist Soda, Hawaiian Punch, Canada Dry and many more consumer avorites, across the United States, Canada, Mexico and the Caribbean.

Currently the third largest refreshment beverage business in North America, Dr Pepper Snapple Group (DPS) www.drpeppersnapplegroup.com) is on a mission to become the best company in its market. Established in 2008 following the spin off of Cadbury Schweppes Americas Beverages from Cadbury Schweppes plc, DPS now manufactures, markets and distributes more than 50 brands, including Dr Pepper, Snapple, 7UP, Mott's, A&W, Sunkist Soda, Hawaiian Punch, Canada Dry and many more consumer avorites, across the United States, Canada, Mexico and the Caribbean. "When you compete in an industry dominated by heavyweights, you must place your company on the cutting edge of business processes in order to provide unique value to your retail customers," explains Craig Hodnett, vice president, Category Management, DPS.

This philosophy is precisely why the company is currently working on a business case for the deployment of a company-wide initiative to integrate downstream data into all of its operations -- from information technology to sales and marketing to customer development and more.

"In order to sustain a data delivery system that permeates an organization, there must be small wins along the way," says Hodnett.

The beverage giant identified category management as a starting point because "the value proposition is clear and the market is ready."

By effectively leveraging downstream data, DPS can achieve one such "win" in fulfilling its vision to become the partner of choice for retailers in each and every category in which it participates.

Avoiding Common Pitfalls

Hodnett, a 26-year consumer goods industry veteran, is responsible for the design and execution of DPS's category management strategy. In collaboration with other company leaders, he is also charged to avoid the four common pitfalls that companies can experience when designing downstream data processes:

Pitfall No. 1: Starting without the end in mind. "In designing data processes, there must be a clear understanding of what the final output will be for the insights delivered to the customer," says Hodnett. If you design a data hierarchy without considering the data hierarchies of your customers, then personnel will waste valuable time manually converting your internal view of data to match customer views.

Pitfall No. 2: Viewing data needs on a project-by-project basis. Hodnett explains, "When a retailer chooses a supplier for space management within category management, a stream of data must be cleaned and then translated for this one project. Later, the same retailer could choose the same supplier in the area of promotions. Again, a separate data stream must be cleaned and translated before insights are generated. Surprisingly, many companies are stuck in this rut."

Pitfall No. 3: Discounting the importance of a common data stream approach. Because manufacturers operate across multiple channels with many customers, the task of cleansing and translating data into actionable insights is magnified. "Today, many retailers are deploying many different demand signal repositories (DSR)," says Hodnett. "This situation only increases the inefficiencies caused by the instance of multiple customer DSRs for a manufacturer."

Pitfall No. 4: Misusing enabling technologies. Hodnett says, "Even when a common data stream delivery format is chosen, many companies do not set their software for maximum efficiency and productivity." In a marketplace where speed is of utmost importance, this compromises valuable time.

The Starting Point

Improvements in DPS's category management operations demonstrate the value that the effective use of downstream data can deliver. The objective of its category management initiative was to enable sales teams to quickly generate insights using clean and accurate data without contacting a category management support partner.

"We wanted to show value quickly to the organization in the area of insight generation from raw data to our retail customers," says Hodnett.

Three core competencies would enable DPS to do so; speed to insight, efficient assortment and space management. These competencies required the abilities to coordinate incoming data streams from various sources and automate the analysis of a 100-plus page deck of information using configurable parameters to generate the desired insights.

In Hodnett's experience, more than 80 percent of the aforementioned analysis can be done via Smart Text. DPS was able to identify missed sales down to the channel, retailer and even SKU level.

What DPS could not do was determine why something happened. For example, why did a product experience lower than expected sales? Why was the ad lost? And how will the volume be made up in the future.

"This causes the sales person to spend his or her time on solutions to the customer rather than on insight generation," says Hodnett.

DPS implemented Interactive Edge's XP3 Suite (www.interactiveedge.com) five years ago to fill in the blanks. XP3 enables DPS to streamline the process of data integration, production and dissemination of custom presentations for category management.

The company also appointed a Data Architect three years ago who acts as a direct liaison to DPS's IT group and is responsible for the design and development of insight delivery systems for the department.

Most recently, DPS implemented JDA Planogram Generator from JDA Software Group (www.jda.com), which aims to enable companies to create greater quantities of highly detailed planograms more efficiently.

The tools from Interactive Edge and JDA work together to generate insights directly from DPS's planogram data increasing its productivity of insights by 60 percent.

"Connecting all of our software with our data streams in category management has enabled us to cut our time per space management project by more than 65 percent," reports Hodnett.

This means, according to Hodnett, that DPS can take on additional categories at any given retailer in addition to engaging more retailers in strategic partnerships with the same headcount. And in a headcount neutral environment, Hodnett believes that these capabilities are absolutely critical for a manufacturer to win in today's marketplace.

The Bigger Picture

After receiving positive feedback from its retail accounts based on insights generated from the effective use of downstream data in category management, DPS defined a much larger objective to build a DSR that could receive data from multiple sources, clean it and translate it into a format that multiple departments could use in order to obtain insights.

"Using point-of-sale (POS) data to drive the business offers us an opportunity to rethink virtually every major business process," says Hodnett. "Given our position in the market, we realized we needed to align the organization on a handful of business goals where we could focus and document measurable success to prove the value of a DSR."

While departments within DPS are still collaborating on the business case, the company has identified the following opportunities for value:

- Gain further productivity in space planning/category management, accelerating the speed to insight with access to clean POS data

- Enhance the field execution of promotions across its complex route to market for company-owned and franchised bottlers

- Accelerate the roll out of new products

In summary, downstream data can be a game changer for a manufacturer such as DPS if it avoids the common pitfalls and leverages data effectively across the entire organization. DPS -- through various industry share groups -- is committed to helping the consumer goods industry achieve the productivity gains and cost efficiencies that come along with an effective DSR roll out.

"Leading thought in this key area has enabled both DPS and our retail customers to win in the marketplace," closes Hodnett.

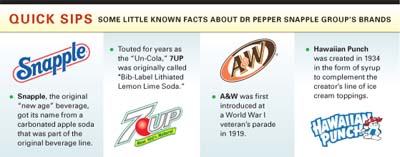

- Snapple, the original "new age" beverage, got its name from a carbonated apple soda that was part of the original beverage line.

- Touted for years as the "Un-Cola," 7UP was originally called "Bib-Label Lithiated Lemon Lime Soda."

- A&W was first introduced at a World War I veteran's parade in 1919.

- Hawaiian Punch was created in 1934 in the form of syrup to complement the creator's line of ice cream toppings.