Promotion Management

Trade promotion discussions permeate the agenda at every sales and marketing conference. Why? It is logical. Significant monies (up to 33% of sales) are spent on trade. As a result, technology providers make strong arguments that companies should use their technologies to drive an improved ROI; but as I watch the audience, I see yawns and arm crossing. The reality is that we have been talking about improving trade promotion management (TPM) for the last two decades without making much progress. The technologists talk. The manufacturers listen, but not much happens. The discussion is about incrementalism in a world of intense change management issues/concerns. We must recognize and get past the fundamental issues:

Incentives. Alignment of Sales and Marketing. The sad reality is that over 50% of trade promotions are never evaluated for effectiveness. Since sales is incented on volume and marketing on market share, there is often more incentive to not measure it than to measure it. Sales and marketing are not rewarded for profitable promotions. Instead, their incentives focus on growth.

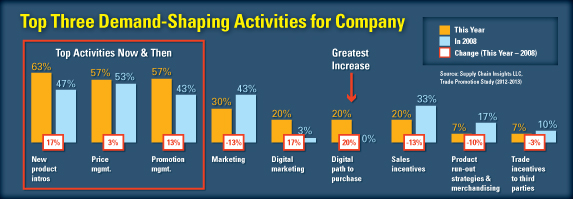

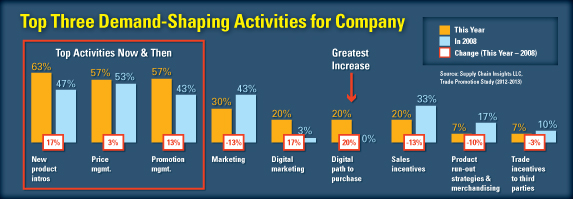

Historical and Conventional Perspectives. The world is changing. When we look at all the demand-shaping options, trade funds are being diverted into digital programs. Today, most (over 55%) of trade promotions are based on history. So, while we have many sources of demand insights, most organizations lack the discipline to apply them. Why? Again, the incentives are not aligned.

Forecasting and Trade Promotion Lift. There are many well-intended projects that attempt to measure promotional lift in forecasting, but we lack history. Most organizations cannot determine which orders represent promotional volume and which do not in the history files.

The Retailer has its Hands in the Manufacturers’ Pockets. Consider that Kroger, a U.S. $82 billion grocery retailer, reported a net profit of 1.1 billion in 2010, but received over $6 billion in trade allowances from suppliers.* When the food retailer makes more money on the buy rather than the sell, the focus for supply chain effectiveness is lost, the need to pursue new technologies is limited, and the execution at store level becomes less important. Kroger’s consecutive year reports continue this trend. It is hard to get serious about automating trade promotion when it is really a cost of doing business.

Global/Regional Governance. Trade is different around the world. The policies of North America are very different than those in Vietnam. The programs need to be very regional. As retailers evolve in global markets these practices are evolving. Companies are still learning.

So what do we do? I think that in the evolution of the practices of the digital consumer, we strike to redefine the dynamics that loom over conventional trade programs. The first step is to define a definitive ROI analysis for digital and e-commerce trade programs. This is new ground free of the change management quagmire. Implement weekly/monthly reporting and tie future spend to trade effectiveness. This is also a great opportunity to side-step the conventional systems (trade promotion technologies built on top of CRM that did not work very well) and build trade sensing analytics from the shelf back. This is a wonderful opportunity to use new forms of analytics like cognitive learning to adapt and learn with shifts in trade programs and market dynamics.

If I see you in the audience at the CGT Sales & Marketing Summit yawning as the TPM vendors attempt to teach old dogs new tricks, you will find me in the balcony tweeting away as @lcecere. I encourage you to strike while the iron is hot to redefine trade programs in digital marketing, but to rethink incrementalism in conventional trade. I just think that we have not made much progress, and the conventional obstacles and the odds are getting worse, not better.

* Source: Kroger 2010 Annual Report

Incentives. Alignment of Sales and Marketing. The sad reality is that over 50% of trade promotions are never evaluated for effectiveness. Since sales is incented on volume and marketing on market share, there is often more incentive to not measure it than to measure it. Sales and marketing are not rewarded for profitable promotions. Instead, their incentives focus on growth.

Historical and Conventional Perspectives. The world is changing. When we look at all the demand-shaping options, trade funds are being diverted into digital programs. Today, most (over 55%) of trade promotions are based on history. So, while we have many sources of demand insights, most organizations lack the discipline to apply them. Why? Again, the incentives are not aligned.

Forecasting and Trade Promotion Lift. There are many well-intended projects that attempt to measure promotional lift in forecasting, but we lack history. Most organizations cannot determine which orders represent promotional volume and which do not in the history files.

The Retailer has its Hands in the Manufacturers’ Pockets. Consider that Kroger, a U.S. $82 billion grocery retailer, reported a net profit of 1.1 billion in 2010, but received over $6 billion in trade allowances from suppliers.* When the food retailer makes more money on the buy rather than the sell, the focus for supply chain effectiveness is lost, the need to pursue new technologies is limited, and the execution at store level becomes less important. Kroger’s consecutive year reports continue this trend. It is hard to get serious about automating trade promotion when it is really a cost of doing business.

Global/Regional Governance. Trade is different around the world. The policies of North America are very different than those in Vietnam. The programs need to be very regional. As retailers evolve in global markets these practices are evolving. Companies are still learning.

So what do we do? I think that in the evolution of the practices of the digital consumer, we strike to redefine the dynamics that loom over conventional trade programs. The first step is to define a definitive ROI analysis for digital and e-commerce trade programs. This is new ground free of the change management quagmire. Implement weekly/monthly reporting and tie future spend to trade effectiveness. This is also a great opportunity to side-step the conventional systems (trade promotion technologies built on top of CRM that did not work very well) and build trade sensing analytics from the shelf back. This is a wonderful opportunity to use new forms of analytics like cognitive learning to adapt and learn with shifts in trade programs and market dynamics.

If I see you in the audience at the CGT Sales & Marketing Summit yawning as the TPM vendors attempt to teach old dogs new tricks, you will find me in the balcony tweeting away as @lcecere. I encourage you to strike while the iron is hot to redefine trade programs in digital marketing, but to rethink incrementalism in conventional trade. I just think that we have not made much progress, and the conventional obstacles and the odds are getting worse, not better.

* Source: Kroger 2010 Annual Report