How Cuisinart and Spread the Love Leverage First-Party Data in the DTC Revolution

There's a universal truth across the CG space: No matter the landscape shifts, technological advancements, or changing customer expectations, consumers will always demand a personal connection.

Using CGT’s recently released DTC and Consumer Insights Report as the backdrop, executives from Cuisinart and Spread The Love Foods share their take on the widespread benefits of DTC. Learn how the CG companies implement modern strategies to overcome unprecedented obstacles related to first-party data and privacy to create a thriving, consumer-focused business flush with deep behavioral insights.

In CGT’s latest webinar, we uncover the impact of today’s shifting privacy regulations and expectations on the DTC space, how CGs are balancing DTC initiatives and retail partnerships, strategies for obtaining valuable first-party data, and how hybrid commerce experiences are turning heads.

Lisa Johnston: Hello, welcome to “The Hidden Benefits of DTC: How to Maximize Your First Party Data Strategy.” My name is Lisa Johnston. I'm the senior editor at CGT.

Today's event is based on a recently published CGT report, “Consumer Data and the DTC Revolution,” which digs into the different ways consumer goods companies are developing direct relationships with consumers and how they're using technology to do so.

The report explores how CPGs are balancing retail relationships while selling direct-to-consumer, where they're seeing success, and some of the interesting benefits of forming these personal connections with consumers. Many of these benefits are extending well beyond sales transactions, which we’ll explore today. The report also has a Snapshot Survey, which is a small audience poll on the challenges and investment plans.

While we will go over the themes of the report, this won't be simply a rehash of the report. Instead, a panel of sales and marketing and DTC experts will break down the biggest trends and provide a first-hand perspective on consumer data in CPG today.

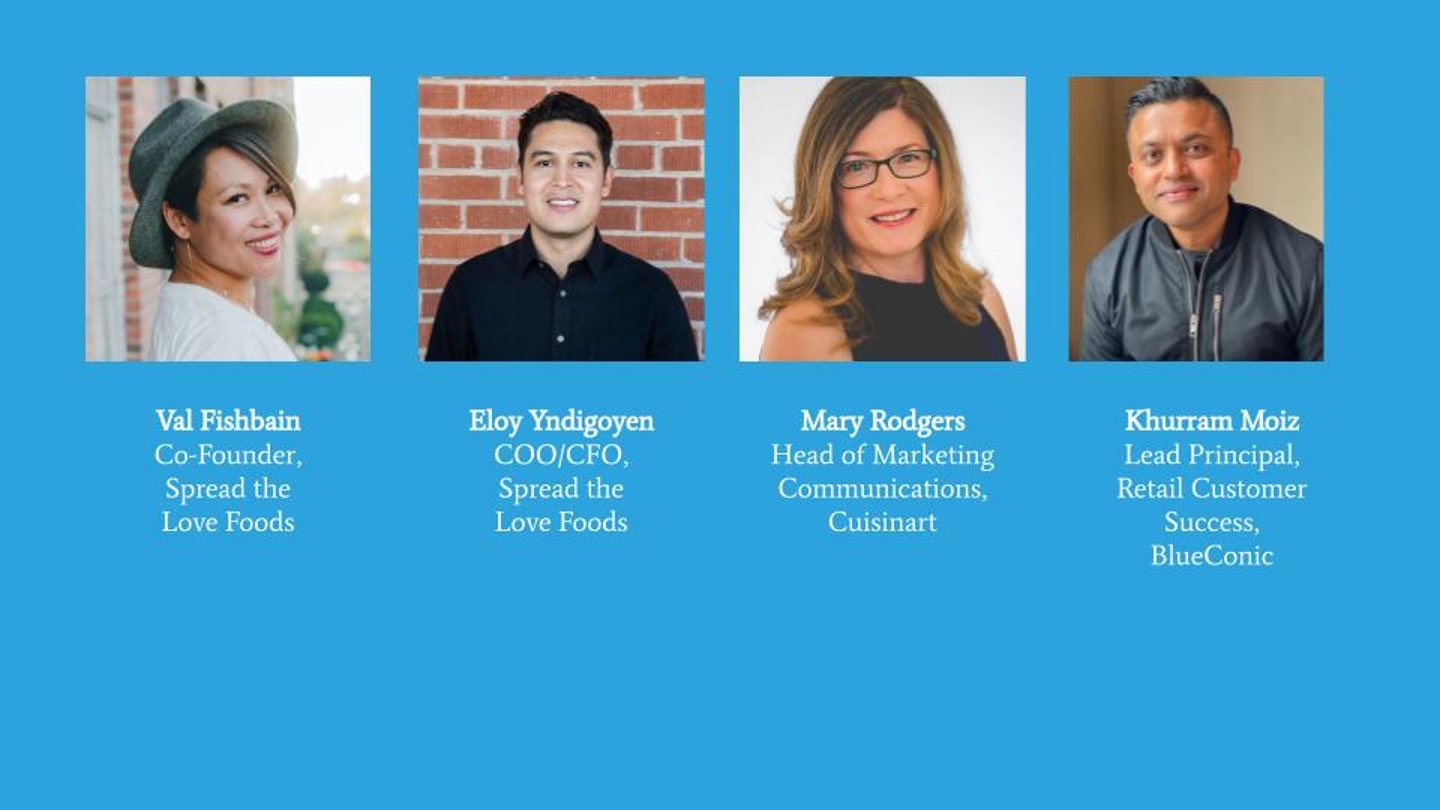

Let’s begin by welcoming our panelists. Joining us today are Val Fishbain, co-founder of Spread The Love Foods; Mary Rodgers, head of marketing communications at Cuisinart; Khurram Moiz, lead principal of retail customer success at BlueConic; and Eloy Yndigoyen, COO/CFO of Spread The Love Foods. First, I’d like each of you to briefly introduce yourselves and tell us a little bit about your company.

Val Fishbain: Hi, I'm Val Fishbain, co-founder and president of Spread The Love Foods. Before it was a food business, it was a wedding gift given to our family and friends about nine years ago. It became such a big hit that our family and friends started asking for the fresh, homemade peanut butter that we had given to them. That was the light bulb moment for us. We started the business and here we are nine years later with one of the best-selling peanut butter and nut butters on Amazon, as well as a thriving e-commerce website, food service channels, and retail accounts.

Eloy Yndigoyen: As Val said, Spread The Love Foods is operating as an all-natural food company, fueling healthy lifestyles. The majority of my role, from the finance and operation end of things, focuses on the accounting and general procurement of products, as well as e-commerce. We've grown our website dramatically over the last couple of years and throughout the COVID pandemic. We've been able to scale our Amazon presence, making our web address: amazon.com/spreadthelove.

Mary Rodgers: Hi, I'm Mary Rodgers, head of marketing communications for Cuisinart. I've been with the organization for 26 years. It's been a very long time and things have changed dramatically. My team oversees lots of areas, but the one we're going to be speaking about today is D2C and e-commerce across the entire brand portfolio.

Khurram Moiz: My name is Khurram Moiz, lead principal of retail customer success here at BlueConic. I can’t publicly admit how much peanut butter we go through, but we love Spread The Love, thank you very much for introducing us to marionberries. Cuisinart, obviously, has a permanent place in our kitchen, thanks for everything you guys do.

BlueConic is an industry-leading pure-play customer data platform. We liberate companies' first-party data and make it accessible wherever and whenever it's required to help transform customer relationships and drive business growth. My focus is on retail and consumer products, which is my background in general. Prior to being here, I was driving marketing analytics, audience intelligence, and mar-tech capabilities as the client myself. I have been in the trenches, just like many of you.

Johnston: I’m thrilled to welcome all of you here today. One of the biggest themes in the report is exploring how consumer goods brands can balance retail relationships once they go direct-to-consumer, whether they're selling direct-to-consumer or forming those personal connections. For a long time, there was concern for many companies, especially the larger legacy brands, that selling DTC would harm the important relationships with retail partners.

As a result, many CPGs shied away from doing so, or might have dipped a toe in the water to test things out on a small scale. Then, of course, the pandemic changed everything. It changed consumer behavior in unprecedented ways and there have been shifting privacy regulations that made having a first-party relationship with consumers a much greater imperative.

We're going to dig into that, but Mary, could you tell us a little bit about Cuisinart's DTC journey and how it's evolved during the digital acceleration of the last two years?

Rodgers: We've been selling D2C for a long time in different ways. We had a big direct mail business for several years and switched over about 15-20 years ago to a web-based platform where we were selling direct to consumers. They were having our experience on the web platform, but we were using an outside fulfillment company. What ended up happening in late 2018, we had a lot of issues with the fulfillment company and our organization built a $54 million pick-pack facility in Arizona, so somebody needed to use it.

I was one of the first people to take advantage of that situation corporately. Conair is a $2B+ organization with many brands, but Cuisinart tends to be at the forefront of many D2C and e-com activities. In late 2018, we brought that back in-house where everything is self-contained from the pick-pack, the online experience, and the customer support. I decided to keep that internal rather than using our outsource facility, so we could manage the entire stream.

Sometimes people forget that you're running an entire business when you're selling D2C and running an e-com business on behalf of a brand.

Johnston: Val, on the flip side, Spread The Love Foods has been DTC since its founding. Can you tell us a little bit about your background, but also how the strategies have changed in the last two years?

Fishbain: Over the past couple years, we’ve put focus on our website, especially on Amazon, because of the pandemic. Everybody came to us because they couldn't find peanut butter at stores at the beginning of the pandemic. Within the past two years, we've leaned heavily on email and SMS marketing. This is where we see the advantage of people having phones in their hands all the time. As soon as we send an email or SMS notification — they open it.

We have been able to tailor our marketing strategies toward customers’ wants and needs, not just the promotion and sales. Everybody wants discounts and promotions, but we have recipes and giveaway collaborations with other brands, which our customers like. We've also allocated our budget to the Amazon marketplace because it is a huge platform for us. This is where many customers find us, and we get a lot of customers that visit our website through Amazon. It's been an advantage for us to spend ad money there.

Johnston: Eloy, how do you balance those direct-to-consumer efforts, without cannibalizing retail partnerships?

Yndigoyen: For us, it's not incredibly difficult because we don't have a significant retail presence. We spent heavily on what I’ll call general Amazon advertising in late 2018. In early 2019, when the pandemic hit, we slowed down advertising spend because sales were up significantly — I didn't want to advertise anymore. Then, I re-engineered the marketing spend to focus a bit more off-Amazon because we had a significant number of new customers find us on Amazon as Val was mentioned, and then ultimately found us on our website too.

The way we're able to obtain a lot of that customer information is because sometimes Amazon makes mistakes. Sometimes customers reach out to us through the Amazon platform, but we're able to create a connection with them and convert them to a website customer. That has been a helpful way for us to first grow Amazon sales and now we're seeing the non-Amazon sales grow, as well.

Johnston: Khurram, the clients that you work with and the perspectives you hear from the retailers, how are they seeing success with this great juggling act?

Moiz: Great question, it’s important to get the perspective from a retailer’s lens. A few years ago, omnichannel used to mean, “don't forget e-commerce.” During the pandemic, it became solely e-commerce, which is what Val and Eloy are alluding to. As things have started to open up, physical retail has seen quite a resurgence and consumers are back to shopping in-person.

There was a study last year by the Bank of Montreal Capital Markets Group that underlined the margin and volume benefits of retail versus DTC. It’s a fact that retailers broadly, but absolutely realized that this juggling act is real and critical for consumer products companies to own the customer relationship while also elevating the brand. Where are retailers finding themselves today in this juggling act?

They’re looking for the ability to partner on initiatives that allow them to bring exclusive offers, products, and experiences. Similar to what Nike and Dick's Sporting Goods are doing in terms of linking loyalty programs. Of course, a lot of that is built off the ability to learn from and evolve quickly on first and second party data through data clean rooms.

The fact that consumer products are continually looked at as a component of the overall channel continues to nurture and maintain those relationships in a way that fits the needs of what customers are looking for, and what they know from first-party data, which ends up being a win-win for both sides.

Johnston: Mary, as a larger brand, is what Khurram is saying ring true for Cuisinart as well when it comes to balancing those relationships?

Rodgers: For us it’s very important because the percentage of D2C sales versus the percent of the total corporate revenue is growing significantly. It's not meant to replace that relationship, but to bolster profits and continue to grow one-on-one relationships with consumers. We put a lot of effort into the digital space with our retailers.

My team helps audit their content — make sure they have best-in-class content, the right information — and we put a lot of effort into our product information system that drives the digital shelf for them.

We're not reducing those efforts, we're increasing them significantly to be more competitive in the marketplace in general. My team is also heavily involved in the Amazon platform in many ways. Not just in the marketing space, but also the marketplace control space. We put a lot of effort into shutting down unauthorized third-party sellers and making sure that the digital shelf across the entire environment is clean and fair for all retailers, including ourselves.

Whenever we run promotions, we participate in the same promotion to stay competitive in the marketplace.

Johnston: There are lots of nodding heads. It sounds like keeping in the theme of rising tide lifts all ships.

Yndigoyen: To speak on the retail presence side, for a company like Spread The Love, where we started online, it's helpful for now having these retail conversations. We were at a trade show last month, where we met potential retail partners. They were speaking to us and asking how our product is performing on Amazon.

Johnston: Having access to that data. Let's talk about data, but also some of the challenges that come along with it, roadblocks, or hurdles. As part of the report, we dug into the challenges that come with building and maintaining direct-to-consumer relationships. What we found is that it varies based on the reason why a company has decided to build consumer connections.

In the report, we spoke specifically about the alcohol beverage and spirits market, which carries regulations and complications in selling DTC. Nonetheless, alcohol beverage brands are developing their consumer data strategies.

Khurram, BlueConic specifically worked with Heineken for their consumer data strategy. Can you talk about some of the ways companies are using the first-party data when it's not necessarily just for sales? Of course the sales and revenue is the most important, but there's other reasons why this is a benefit.

Moiz: The Heineken example is amazing, but I'm going to broaden that a little bit. The power and impact first-party data can have across a broader organization at any company is phenomenal. We have customers that are using first-party data to better understand and engage consumers from a marketing perspective, and to personalize experiences and journeys.

Now, it's being leveraged to inform merchandising when it comes through product development and product launch. It's used to influence how loyalty programs are launched or evolved, to step away from a one-size-fits-all to something that's more catered toward the individual in terms of incentives and cadence. To the point where, even inventory management and demand forecasting are all the interest around first party data and finance is involved in those conversations.

One great example is Disney and their use of the mobile app. Think about the power of that mobile app and the first-party data that is available to them for the entire consumer journey, whether it's before you get to the park, at the park, or even after — how they're behaving throughout that journey, their needs, intents, the experience — and how that can help evolve the broader way Disney goes to market.

Once again, that should convert back to sales, loyalty, brand preference and so on and so forth. Amazing stuff being done with first-party data in general.

Johnston: Disney's a great example. I just got back from a trip to Disney and the personalization was incredible. I'm waiting for the follow-up emails now that we've returned. Mary, Cuisinart's done quite a bit with this, I'd like to get your take on how to leverage first-party data when it comes to personalized consumer connections.

Rodgers: The biggest place we're focusing on first-party data is we've built a database over the years. We were selling direct-to-consumers for quite a long time, we use our warranty system to collect more first-party data, and we have that feeding the review process or syndicated review process. What we're doing with that first-party data is around our email campaigning. We know when a consumer has bought a food processor, we will follow up, and give them handy tips on how to maintain it, how to use it, and lots of recipes.

We also do some aftermarket. We have a welcome program and many ways that we keep in touch with those consumers. We are also using that across key categories, such as food processors, coffee makers, and air fryers, and are continuing to build that out as we move forward. Under consideration is taking some data from other places and building out a complete data set for marketing purposes. Right now, we're heavily reliant on the first party data that we've built through our warranty system.

Johnston: Val, from the food category perspective, how are you leveraging first-party data to build loyalty with consumers, beyond those who are complete peanut butter addicts already?

Fishbain: We’ve learned so much about first-party data that we're able to tailor marketing toward what customers want and need. A typical PB&J sandwich recipe is old, traditional, and great, but they want more now. They want a soup that is made with peanut butter, or creative ways of using our peanut butter, jams, and granola.

Johnston: I'm glad you mentioned SMS marketing as we’ll dig into that in a bit. Khurram, did you want to build on that?

Moiz: I love that there is an actual connection with the customers. The end-customer knows who they're dealing with. Hopefully, out of that comes knowing who these folks are and evolving how to go to market, how you're communicating, what the products look like, and so on and so forth. I'm not going to commit to trying the peanut butter soup, but I'd love to see that come out if it does.

Fishbain: Actually, a recent example is Zach's birthday. We just ran a promotion that said, "We're celebrating!" It turned out to be one of our biggest promotions. Now, we know that we're going to celebrate every birthday in the company. Building that consumer connection makes people feel personally invested in a brand.

Johnston: Let’s shift gears a little bit and talk about tech investments. Essentially, as part of our snapshot poll, we asked the CGT audience about their timeline for a series of tech investments related to consumer data. Eloy, can you talk about the tech investments that are on your roadmap right now when it comes to upgrading DTC capabilities?

Yndigoyen: We're in the process of having an onboarding call with the company that creates shoppable short-form content, which will be on our website, too. What we're finding with the first-party information, is that we are able to see who's coming to our website and what kind of interactions they're having. We revamped our website in late 2020, early 2021. We’ve had a lot of customer feedback over the years and were able to find a company that helped us create a brand-new website almost from scratch.

What we're finding is that we should be creating more reasons for them to click around the website and then also purchase our product. This shoppable form of content — Val can speak to more of what the content strategy will be — but that's one particular technology investment that we're making extremely soon.

Johnston: Val, do you want to build off that? I'm eager to hear about SMS and text messaging marketing.

Fishbain: To talk about the content that we're going to be doing more of — that’s video content. Everybody wants to watch TikTok and Instagram reels nowadays, so we're going to put that on our website. We're focusing more on SMS marketing, which is highly effective. It makes consumers feel like it's something personal when they see a text from us. We use the word VIP to make it feel like an exclusive group. Most of our SMS subscribers are also subscribed to our emails, so it serves as a second level there.

Johnston: You mentioned some of this began before the pandemic, you had already built up this audience base. Has it unlocked any new opportunities for you? Maybe any unexpected opportunities?

Fishbain: Our SMS marketing began right after the pandemic and we're still building it out. It's looking pretty good.

Johnston: Mary, Cuisinart re-platformed its website during the pandemic. Could you talk about the process behind that, the opportunities that it's unlocking, and perhaps any other investments that are on your roadmap?

Rodgers: We knew that we were working on this re-platforming — it was in January and then the pandemic hit in March, we finished in early July. We went from a complete custom PHP, to using the platform called Optimizely, previously known as Episerver. The biggest reason was because when you're on a custom PHP, you're in marketing lockdown. You have to rely on them for everything, your agency partner, your developers.

By moving toward this new platform, my team is able to build our own content. We are completely in charge of all the day-to-day operational things that we previously relied on an agency partner for.

Everything we do is geared toward marketing automation. One of the things that we're almost finished with is using the product information system to drive the product pages on our web platform. It's a lot easier to do updates in the product information management system than to go through that process on the web platform. That's one of the big investments this year.

The other two things that we're working on are building out social commerce and building out affiliates. We had tested social commerce out a few years ago, and were actually a little too early for consumers. Then, building out affiliates because we're seeing a lot more editorial being pushed toward certain retail platforms, where those editorial pieces would normally have been driven toward our website. Affiliates are going to help us drive more sales and traffic to our website hub.

Johnston: Khurram, what’s your take on the overall DTC investments? Has anything you've heard really resonated with how you work with your other CPG clients?

Moiz: It absolutely resonates. The verticalization of this space that Cuisinart is going through is phenomenal — it's a huge effort. It requires a lot of varying capabilities, but you end up truly owning that aspect from start to finish — the journey and relationship that you're trying to have with the consumer. I commend you and the team at Cuisinart, Mary, it's phenomenal stuff.

There are quite a number of technologies that are truly foundational to any successful business. You'll find that a lot of the investments in that have already taken place and there's a lot of improvement in optimization that's taking place. (They're significantly blue on this chart.) On the other end of the spectrum are those capabilities that are more complex and we're still trying to figure out how they fit in the grand scheme of things, how to extract the value from those.

Those are things like artificial intelligence, machine learning, and NLP, which have great opportunities, but we're trying to figure out exactly what makes sense.

What I love about this chart is that smack dab in the middle is customer data platforms and customer experience management, which are intertwined. This chart underlines the fact that CPGs, which make up about 75-78% of the respondents in this survey, are looking at that as the next phase of digital transformation.

Being able to harness first-party data and make intelligent decisions based on that to provide consumers the right type of experience that's engaging, personalized, and what have you. Ideally, you're doing it in a way that you control that vertical, which is where Mary and Cuisinart is headed.

The fact that in 2020, the global market was estimated at about 440 billion — and that's going to grow to 3.4 trillion, potentially, in 2028 — based on this report, it's a 9X increase. That’s something that all of us CPGs and retailers need to keep our eyes on and make sure that we're structured in a way to extract the value proposition.

Johnston: It's going to be interesting on what this is going to look like next year once we've been able to better define the use cases and value in some of those categories that we're still trying to figure out. One of the things we've often heard is that direct-to-consumer and first-party data is thought of as marketing's responsibility. Would you all consider that to be true or false, and why not? Mary, has this always been your responsibility and do you think it should lay solely with your team?

Rodgers: Yes, it's always been my responsibility and it should lie within marketing. At the end of the day, we're the ones tasked with building the brand long-term. In our business, I don't believe in microsites and building out small others. We drive everything to the web property and that's the main focus. That is a big place for our brand, every day of the week, and that's something that has to be run by the head of the brand.

Yndigoyen: I agree, 100%. It's interesting because as the marketing profession evolves, it's helpful to have that quantitative background, as well — with knowledge of operations and finance. We are hiring right now, and a lot of the people that we're speaking to are able to develop content, create content, and are able to be brand managers and brand marketers. But they also have that quantitative focus because they want to get an understanding of how much engagement they're having on their social platforms.

They want to get an understanding of what the click-through rates are on the website, and they want to be focused on the right metrics. It’s interesting to see how the marketing field and the marketing profession, in particular, are evolving.

Johnston: Val, do you have anything to add, your thoughts on that?

Fishbain: While I agree that it's the marketing responsibility, at the same time, we're a very small team, so it's all of our responsibility.

Johnston: Khurram, is it aligned with what you hear from other brands that you work with?

Moiz: Yes, we hear that from a lot of brands that we engage with where marketing is the head of that initiative. What we are quickly seeing, and this is evolving, is that those silos are starting to break down in terms of the voice at the table from some of the other parts of the organization. It depends on what the strategy of DTC actually is.

Are we trying to elevate our brand, are we trying to drive additional volume, create awareness, or what have you? There are a lot of perspectives that come into play there, but what we've seen for the most part is marketing's driving the initiative in general.

Johnston: You mentioned that you are seeing silos begin to break down. We have the top three challenges and one of them is the culture of the company resisting this DTC pivot. Which of these challenges stand out to you and how have you seen technology being used? Our audience is, of course, all senior tech and IT executives, how can they use technology to help with these challenges?

Moiz: Looking at this list of challenges, these aren't atypical. Everyone's dealing with the same set of challenges and issues, especially when it comes to the culture of a company resisting this DTC pivot. What we've found to be extremely helpful is the ability to show, through real data, the value of moving toward that channel, and if that makes sense for that company, that client of ours.

When you start thinking about this list of challenges, focus on the inability to integrate data from multiple sources, that’s a key one here. Tackle that first and in a way that allows you to get an answer very quickly. That means onboarding capabilities, such as a customer data platform that pulls all the data together, unifies the profiles, and allows you to hear what consumers are telling you.

As you’re doing that, you’re hoping to do it in an automated fashion that's scalable. Some of the resistance, in terms of having limited resources or the right staffing isn't in place, alleviates some of that pressure because these capabilities don't necessarily require a highly specialized skill set in order to learn from and execute.

Say we've got the data, we've been able to understand who our consumers are, maybe even execute some experimentation in this space. Then, you’re able to continue to start showing that back to the broader organization and adjust some of that cultural mindset toward a path that allows you to bring them along on that DTC journey.

There's absolutely a path to addressing these challenges. Think about it in a way that's consumer-centric, data heavy, and there are platforms such as BlueConic's that can help support that.

Johnston: We had asked what the future of DTC looks like in an ideal world, as part of our snapshot poll. What does it look like to you, and do you think every CPG needs a DTC strategy? If not, why or why not? Eloy, what do you see as the future of DTC? Would you encourage all brands to form those relationships?

Yndigoyen: 100%. Again, hyper-personalization is the core of what we're trying to do here at Spread The Love, and I'm sure what many other brands are trying to do as well. To have a better understanding of who our customer is, or who our customer is not is very important to us. We're trying to create a successful plan to balance out the Amazon, and non-Amazon, side of things, too. We got a bit too Amazon heavy during the pandemic, but for us it was a channel that grew out exponentially.

Now, as we're settling into this new normal in 2022 and beyond — as you mentioned before that rising tide lifts all boats — we’re able to see that growth on our website. Then, we're able to have these conversations with retailers where we're able to show them the growth that we were able to do throughout the pandemic — both on Amazon, and off — and hopefully be able to replicate in their retail stores.

Johnston: Val, what does the future look like for you or for Spread The Love Foods? Would you also encourage all brands to start this journey?

Fishbain: I really do encourage that. A lot of D2C brands collaborate with each other to collect more first party data together. There's a lot of benefit in that. For example, the Nike and Dick's Sporting Goods campaign, and also hyper-personalization as Eloy mentioned. A lot of marketing is tailored specifically to each D2C customer.

Johnston: Mary, as being part of a legacy brand, what do you think the future DTC will be for Cuisinart? Is your perspective a little different, or maybe it's not, on whether all consumer goods companies should have a DTC strategy?

Rodgers: All brands should have a D2C strategy, but our perspective is slightly different because we are a legacy brand. One of the things that we're looking at adding is protecting our brand and business as retailers have greater expectations in financial support. All the big guys are building out their own media platforms, therefore they have expectations for more investments in those areas. We need to be in charge of our brand for the long-term.

That's probably one of the biggest conundrums. The other thing is becoming too heavily reliant on some of the larger platforms such as Amazon, which could become detrimental to the business in the long-term. Not necessarily for my business, but in general.

There's a lot of benefits to having your own D2C business, if done right. The biggest challenges are competing in the marketplace against all other retail properties, and then the talent pool. There's not enough talent right now in e-com and D2C. Even for entry-level positions, it's very hard to find people with the right skillset.

There's a lot going on in the marketplace right now. It's an employee marketplace, not an employer marketplace. We're finding that candidates have unrealistic expectations in compensation, even for entry level positions.

Johnston: That's interesting. The talent battle could be its own webinar, at this point. Khurram, what do you think the future is? Can you specifically address the shifting privacy regulations and what we should know when it comes to building those DTC strategies?

Moiz: This question has a bit of an additional caveat here, which is, what does the future of DTC look like in an ideal world for your consumers? For every CPG that is looking to get into this, there is likely a play here and what the future looks like is probably a mix of these — from a highly seamless, fully integrated capability in the channel to, experimenting and trying to learn and understand consumer behavior. We can harness that first party data directly.

That's where some of the regulatory impacts come into play and start driving CPGs toward this channel. The ability to not have to deal with wall guards and deprecating third-party cookies, but being able to set up a framework and an experience for your consumers to either supplement what you're already doing, or create new channels and start driving things such as brand awareness, consideration, and testing into new loyalty programs.

What the future holds, I wish I had that magic ball, but it's top of mind for a lot of consumer products companies and one that they're actively pursuing right now.

Johnston: Val, are you able to provide any more, or are you able to share any information about how you're measuring success of SMS marketing? Are you able to share maybe any of the KPIs that you use or how you know when a campaign is being successful?

Yndigoyen: I can speak to that. Conversions are extremely important for us. Revenue is extremely important for us, too. One other metric that tends to get overlooked is how many people unsubscribed. To me, that shows that they were not enjoying the messaging — perhaps it was what time it was sent out at, it was too early in the morning or too late at night, or some of what the content was.

Conversions are extremely important, how much revenue was generated, but also how many people unsubscribed after that also.

Johnston: Then you're really cutting off that relationship with them once you've lost them.

Yndigoyen: Exactly. What caused them to decide they didn’t want to hear from the brand anymore? That would cause us to go back to the drawing board and see what went wrong there.

Johnston: Khurram, what are some of the new data sources, or the emerging data sources, that CPGs are finding valuable or interesting at this point? What’s on their radars?

Moiz: There's a ton of focus right now on retail media networks. About 74% of brands have allocated a portion of their budget toward investing in these, that's pretty phenomenal.

As consumer products companies are interacting and engaging with customers on these highly-targeted, attentive platforms, the performance data that's coming out of these retail media networks is extremely interesting, and becomes another aspect that should be folded into the broader understanding of every single consumer.

The ability to use data clean rooms to share some of that information, as well as the ability to decide or learn what a consumer looks like in one retail media network versus another, what the behavior looks like, how that changes as well as if they’re investing in the right retail media network.

Should they be exploring other avenues or adjacent avenues? This area is super interesting, and it has a lot of focus. Now it’s starting to become part of the broader decision making process.

Johnston: Do you have any best practices you can leave CPGs with, those who are just getting started with direct-to-consumer, or might still have some heavy listing to do?

Moiz: I'm very much a proponent of first-party data, understanding your customer, knowing exactly who you're speaking with. We don't want anonymous folks coming through. Well, we do, but we want to know exactly who these people are as quickly as possible: what their interests are, what experiences they're looking for, how can we evolve the business?

You don't necessarily have to go full on, this is something that you can experiment into. You can partner with companies, there are other organizations and companies that are willing to partner on data and initiatives. If you're getting started on your DTC journey, there's a lot of opportunity and tons of areas to explore.

Johnston: Those are great words to leave us with, ending with partnership. I'm afraid that is all the time that we have today. I'd like to thank you all for joining, sharing your insight today. I'd like to thank BlueConic for sponsoring the webinar, and I'd like to thank our attendees for giving us your time today. Have a great rest of your day