Unilever's New Direction: Streamlined Portfolio, Leadership Refreshes, Power Brand Prioritization

Unilever has revealed a new plan of action, focusing attention on high-performing brands in its portfolio and implementing key new leadership appointments. Part of this strategy involves selling off DTC male grooming brand, Dollar Shave Club, which the company purchased in 2016 for $1 billion.

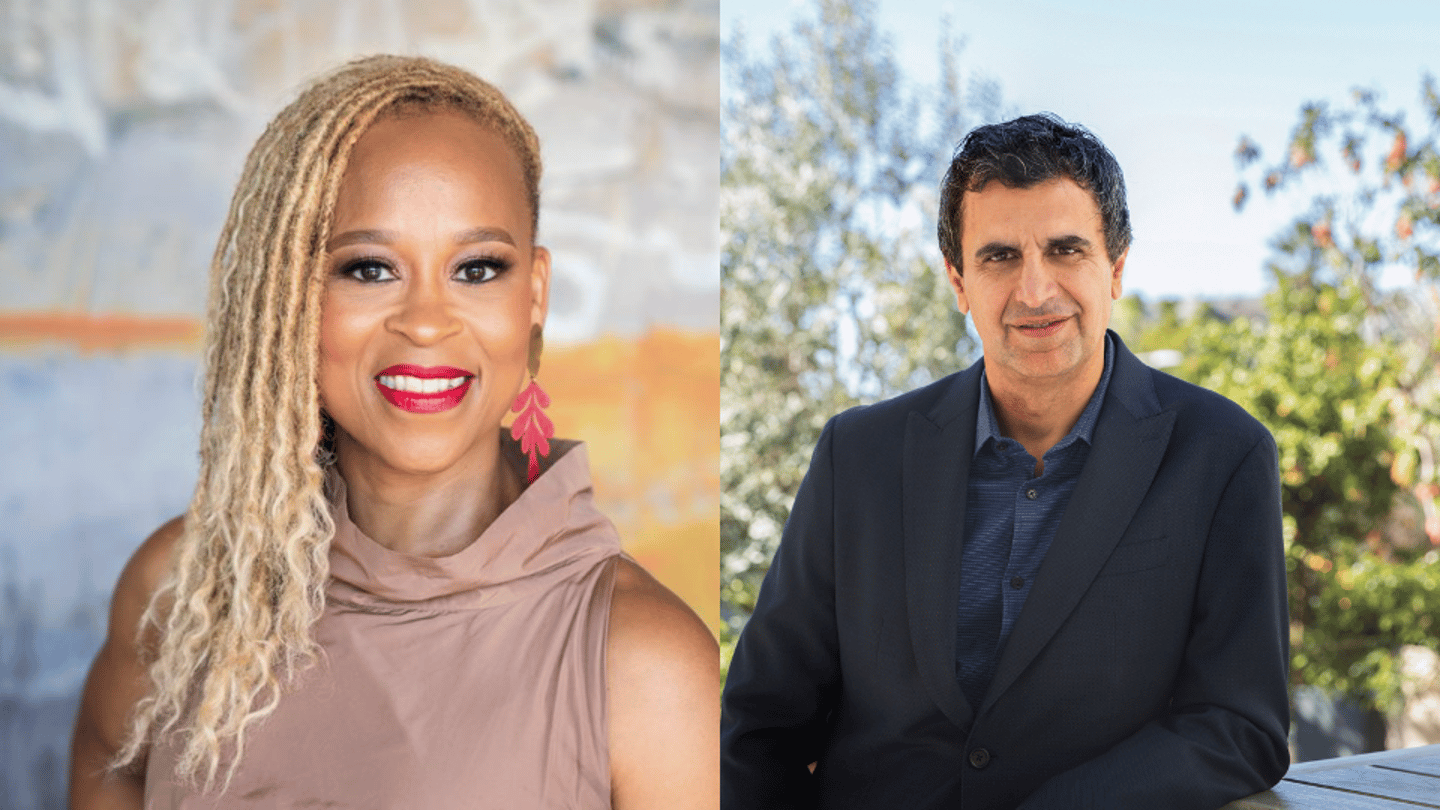

The company has also announced changes to its C-suite, naming Esi Eggleston Bracey as its new chief marketing and growth officer and Fernando Fernandez as its new chief financial officer.

The Dollar Shave deal means Unilever will retain a minority 35% shareholding, with Toms owner Nexus Capital Management taking on a majority share. While the financial terms of the transaction have not been disclosed, the deal is expected to be finalized this year pending standard closing conditions.

The news comes on the heels of disappointing financial results for Unilever’s Q3 of 2023, with sales dropping 3.8% compared to last year's figure.

- See Also: CGs Strengthen Supply Chain Leadership: Under Armour, McCormick & Lemon Perfect’s New CSOs

In a statement, Unilever CEO Hein Schumacher outlined an action plan to address the issues through a focus on cost management, productivity gains, and production and logistics innovation. The company says it has been conducting extensive benchmarking to set “challenging” productivity targets and decrease costs per unit produced and also plans to implement end-to-end network optimization and “supply chain resets” in North America in the personal care, beauty, and well-being categories.

“The biggest cost line for our organization is material costs, including raw and packaging materials, as well as products purchased from third parties. We are actively working on beating market inflation and contributing to gross margin progression through competitive buying, value chain interventions, and product reformulations,” Schumacher shared.

Power Brands Focus

Schumacher, who assumed the CEO position in July this year, acknowledged that “[Unilever’s] performance in recent years has not matched our potential. The quality of our growth, productivity, and returns have all under-delivered,” and laid out the company's new strategic direction.

The focus will now be on 30 key brands which make up 70% of its sales, Schumacher said. The primary objectives include improving gross margins, scaling back its portfolio, and avoiding large-scale acquisitions.

“We will drive faster growth by stepping up innovation and investment behind our Power Brands; we will drive simplicity and productivity, leveraging the full strength of our operating model; and we will sharpen our performance culture through strong leadership and stretching goals,” Schumacher shared.

These power brands include Dove, Magnum, Hellmann’s, and Nutrafol. “These brands will have the first call on capital and resources,” Schumacher explained. “They represent our biggest value-creation opportunity, which means they need to be brilliantly executed and consistently supported before anything else. This doesn't mean other brands are not important or will be sold or underinvested, but it does mean we can address the issue I referred to earlier – too many projects competing for in-market execution and brand support.”

Dollar Shave Sale: Why It Matters

Given the messaging behind Unilever's new direction, the majority sale of Dollar Shave Club could signal the first of a number of smaller portfolio sales for the consumer goods giant.

Dollar Shave Club was one of the first DTC subscription-based shave brands on the market, and had leaned into this model throughout its growth, including through its 2016 acquisition by Unilever. Late last year, however, Dollar Shave revealed plans to migrate its in-house solution and outsource its subscription-based technology to a third-party platform provider.

Commenting on the news of the sale, Dollar Shave Club interim co-CEOs Mary Jensen and Dale Brockmeyer expressed gratitude to Unilever for the support while looking ahead to a “strong” partnership with their new buyer.

Executive Changes

The consumer goods giant has named Esi Eggleston Bracey its new chief marketing and growth officer and Fernando Fernandez as its new chief financial officer.

Bracey has been at Unilever for more than five years and currently holds the role of both president of USA business and CEO of personal care in North America. Bracey has moved internally to take over from Conny Braams, who stepped down in August after 33 years with the company. Prior to joining Unilever, Bracey spent over 25 years at P&G working across various roles, and also served a short stint at Coty.

In a separate development, Unilever announced it has appointed Fernando Fernandez as its new chief financial officer, effective January 1, 2024. Fernandez, who is currently serving as the president of Unilever's beauty and wellbeing business group, will take the reins from Graeme Pitkethly, who announced his retirement from the company earlier this year.